Liability insurance trends 2024 california – California Liability Insurance Trends 2024 sets the stage for a captivating exploration of the evolving landscape of insurance in the Golden State. This deep dive examines the key shifts, regulations, and emerging technologies impacting policyholders and businesses alike, from the traditional auto and homeowners policies to the innovative alternative models reshaping the industry.

The year 2024 promises a dynamic interplay between established frameworks and emerging trends, presenting both challenges and opportunities for navigating the complex world of liability insurance. From the evolving risk profiles of diverse industries to the increasing demand for specialized coverage, this analysis provides a comprehensive overview, offering insights into the cost, availability, and future trajectory of liability insurance in California.

Overview of Liability Insurance in California 2024

The California liability insurance landscape in 2024 is a complex tapestry woven from stringent regulations, evolving risks, and diverse policy options. Navigating this intricate system demands a keen understanding of the legal frameworks, available coverages, and potential exclusions. The shifting economic climate and emerging technological threats further complicate the picture, demanding constant adaptation and vigilance from both consumers and insurers.The California Department of Insurance (CDI) plays a pivotal role in regulating the insurance industry.

Their mandates and interpretations directly influence policy terms, coverage limits, and even premium structures. Furthermore, the state’s legal precedents and court rulings shape the interpretation and application of liability policies, adding another layer of nuance to this already intricate domain.

California Liability Insurance Regulations

California’s regulatory environment is characterized by a blend of comprehensive laws and established legal frameworks. These regulations aim to ensure fair and equitable practices within the insurance market. Statutory mandates often dictate minimum coverage requirements for various liability types, such as auto insurance, impacting both policyholders and insurers.

Major Types of Liability Insurance

California’s insurance market offers a spectrum of liability policies, each tailored to address specific risks. Auto insurance, a cornerstone of the market, safeguards against accidents and property damage. Homeowners insurance provides protection against perils affecting residential property, encompassing liability for accidents occurring on the premises. Commercial liability insurance safeguards businesses against claims arising from their operations, products, or services.

Coverage Limits and Exclusions

Policy limits, crucial in determining the maximum compensation available, vary significantly across policy types. Coverage limits are often influenced by factors such as the policyholder’s risk profile and the type of liability insured. Exclusions in policies often delineate specific circumstances or events that the policy does not cover. Understanding these exclusions is critical to avoid financial surprises in the event of a claim.

For example, intentional acts, or damage caused by a pre-existing condition, are frequently excluded.

Comparison of Liability Insurance Types

| Insurance Type | Typical Coverage | Coverage Limits | Common Exclusions |

|---|---|---|---|

| Auto Insurance | Bodily injury liability, property damage liability, uninsured/underinsured motorist coverage. | Varying, often with minimums mandated by law. Examples: $15,000 per person, $30,000 per accident, and $25,000 for property damage. | Intentional acts, reckless driving, and pre-existing vehicle damage. |

| Homeowners Insurance | Liability for injuries or damages occurring on the property. | Often $100,000 – $300,000 per occurrence, depending on the policy. | Intentional acts, damage from war, earthquake, or flood (often excluded unless specifically added to the policy). |

| Commercial General Liability | Protection against claims of bodily injury or property damage arising from business operations. | Widely variable, often in the range of $1,000,000 to $10,000,000 or more, dependent on the risk associated with the business. | Intentional acts, pollution, and contractual liability. |

Emerging Trends in California Liability Insurance 2024

The California liability insurance landscape is undergoing a seismic shift, propelled by technological advancements, evolving risk profiles, and a burgeoning demand for specialized coverage. Insurers are grappling with unprecedented challenges, from the rise of cyber threats to the increasing complexity of environmental liabilities. This dynamic environment necessitates a nuanced understanding of the emerging trends shaping the future of liability insurance in the Golden State.The inexorable march of technology is fundamentally altering the way liability insurance is both sold and managed.

Predictive modeling, data analytics, and automation are becoming integral components of risk assessment and policy design. This evolution is transforming claims processes, improving efficiency, and potentially reducing premiums for compliant businesses. However, the integration of these technologies also presents unique challenges related to data privacy, algorithmic bias, and the potential for fraud.

Significant Shifts in Liability Insurance Products and Services

California insurers are responding to changing customer needs by developing innovative products and services. This includes customized policies tailored to specific industry sectors, enhanced digital platforms for policy management, and proactive risk management tools. Insurers are also increasingly focusing on preventative measures, such as providing training and resources to help businesses mitigate potential liabilities.

Impact of New Technologies on Liability Insurance Provision

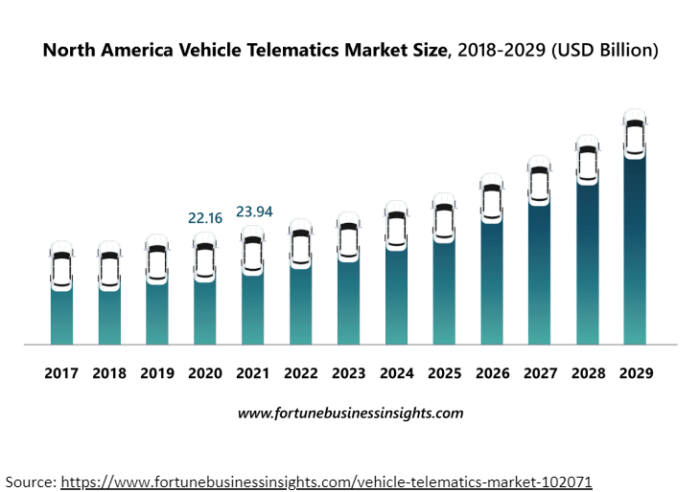

The integration of artificial intelligence (AI) and machine learning (ML) is revolutionizing the assessment and management of liability risks. AI algorithms can analyze vast datasets to identify patterns and predict potential claims, allowing insurers to offer more accurate pricing and tailored coverage options. Moreover, the use of telematics and IoT devices enables real-time monitoring of risks, potentially leading to reduced premiums for compliant businesses.

However, the ethical implications of relying on automated risk assessment systems must be carefully considered.

Evolving Risk Profiles of Different Industries in California

California’s diverse economy presents a complex tapestry of evolving risk profiles. The burgeoning tech sector, for example, faces unique challenges related to data breaches, intellectual property disputes, and emerging technologies. Similarly, the burgeoning renewable energy sector presents risks associated with construction, maintenance, and environmental impact. The insurance industry must adapt its products and services to reflect the specific needs and risks of each industry.

This adaptation requires meticulous analysis of industry-specific regulations and emerging liabilities.

Increasing Demand for Specific Types of Liability Insurance

The growing prevalence of complex legal issues, such as environmental regulations, cybersecurity threats, and product liability concerns, has led to an increasing demand for specialized liability insurance. Cybersecurity liability insurance, for instance, is rapidly gaining importance as businesses face heightened risks of data breaches and cyberattacks. Similarly, specialized environmental liability insurance is essential for businesses operating in industries with potential environmental hazards.

This demonstrates a clear shift towards a more sophisticated and specialized insurance market.

So, liability insurance in Cali ’24 is lookin’ kinda wild, you know? Like, everyone’s gotta be extra careful now, especially with the new regulations. Plus, having a reliable backup power source like the 22 kw whole house home standby generator champion is totally crucial. Gotta protect your home and stuff, right? But yeah, still gotta keep an eye on those insurance trends to make sure you’re covered.

It’s all about staying ahead of the game.

Rise of Alternative Insurance Models

The emergence of alternative insurance models, such as peer-to-peer insurance and micro-insurance, is disrupting the traditional liability insurance market. These models offer potentially lower premiums and greater accessibility for certain groups of consumers. For example, these models are particularly well-suited to addressing the specific needs of small businesses or underserved communities. However, the regulatory environment surrounding these alternative models requires careful consideration to ensure consumer protection and financial stability.

Top 3 Emerging Trends in California Liability Insurance and Projected Impacts

| Trend | Description | Projected Impact |

|---|---|---|

| AI-driven Risk Assessment | Insurers are increasingly using AI algorithms to analyze data and predict potential liabilities, leading to more accurate pricing and tailored coverage. | Improved accuracy in risk assessment, potentially leading to lower premiums for low-risk clients and more tailored coverage options. |

| Specialized Liability Coverage | Growing demand for specialized coverage, such as cybersecurity and environmental liability insurance, reflects the complexity of modern business risks. | Enhanced protection for businesses facing unique liabilities, potentially leading to greater financial stability and compliance with evolving regulations. |

| Alternative Insurance Models | Peer-to-peer and micro-insurance models are emerging, potentially offering lower premiums and increased accessibility to insurance. | Increased competition in the insurance market, potentially driving down premiums and expanding access to insurance for underserved populations. |

Cost and Availability of Liability Insurance in California 2024

The California liability insurance landscape in 2024 is a complex tapestry woven with threads of escalating costs, evolving availability, and a multitude of factors impacting both businesses and individuals. This intricate web demands careful consideration, particularly for those navigating the intricacies of risk management. The financial implications of inadequate coverage are profound, potentially leading to crippling financial burdens.California’s liability insurance market faces a critical juncture.

The confluence of rising claims frequency, evolving legal precedents, and economic fluctuations creates a volatile environment for insurers and those seeking coverage. This dynamic environment demands a keen understanding of the current realities.

Factors Influencing Liability Insurance Pricing

A multitude of factors contribute to the ever-shifting pricing of liability insurance in California. These factors, often intertwined and dynamic, create a complex interplay impacting premiums. Claims frequency and severity are crucial determinants, reflecting the rising cost of medical care and legal representation.

- Claims Frequency and Severity: An increase in the number and severity of claims directly translates to higher insurance premiums. Examples include the rising costs of medical treatment for accident victims and escalating legal fees associated with complex litigations.

- Risk Assessment: Insurers meticulously assess the risk profile of each applicant. Factors like the nature of the business, location, and industry play a pivotal role in determining the premium. High-risk industries, such as construction or transportation, typically face higher premiums due to the increased potential for accidents.

- Policyholder History: A history of claims significantly impacts premium rates. A pattern of accidents or incidents can result in substantial increases in premiums as insurers perceive a higher risk.

- Economic Conditions: Economic downturns or periods of inflation can also influence liability insurance rates. A downturn may lead to fewer claims, but inflation may lead to higher settlement costs.

Availability of Liability Insurance for Different Entities

Access to liability insurance varies across different types of businesses and individuals. The specific nature of operations and associated risks dictates the availability and affordability of coverage.

- Businesses: Certain businesses, particularly those operating in high-risk industries like construction or transportation, may face challenges in obtaining adequate liability insurance at competitive rates. The unique operational characteristics of each business are a crucial factor in evaluating its risk profile.

- Individuals: Individual liability insurance is generally available, but the premium can fluctuate based on factors like age, driving record, and the type of liability coverage sought. The financial implications of inadequate individual coverage can be profound.

- Specific Industries: Insurers often cater to specific industries, offering customized packages that account for the particular risks involved. For example, specialized insurance may be available for professional liability, such as errors and omissions insurance for doctors or architects.

Potential Insurance Gaps and Underserved Segments

Significant insurance gaps exist, leaving certain segments vulnerable. Understanding these gaps is essential for identifying areas where improvements are needed.

- Small Businesses: Small businesses may struggle to obtain comprehensive liability coverage at affordable rates due to limited resources and perceived higher risk. This lack of coverage can have devastating financial consequences for these businesses.

- Emerging Technologies: The rapid evolution of technology often creates new risks that traditional insurance models struggle to address. Cybersecurity and autonomous vehicles are two examples.

- Specific Professions: Certain professions may find it difficult to secure coverage, either due to the unique nature of their work or a lack of dedicated insurance providers. For example, freelancers or independent contractors often face challenges in obtaining suitable coverage.

Potential Impact of Economic Factors

Economic fluctuations play a critical role in the dynamic liability insurance market. Economic factors can significantly affect both the demand and supply for liability insurance.

- Inflation: Inflationary pressures can impact the cost of claims, leading to higher premiums. Rising medical costs and legal fees are directly linked to inflationary pressures.

- Economic Downturn: An economic downturn may see a decrease in claims, but insurers still need to factor in the possibility of increased costs in the long term. These conditions create uncertainty in the market.

- Interest Rates: Changes in interest rates influence investment returns for insurance companies. This, in turn, can affect the overall pricing structure.

Average Liability Insurance Premiums in California (2024 Estimates)

| Insurance Type | Average Premium (USD) |

|---|---|

| General Liability (Small Business) | $1,500 – $5,000 |

| Professional Liability (Doctors) | $3,000 – $10,000 |

| Commercial Auto (Trucking Company) | $6,000 – $15,000 |

| Homeowners Liability | $500 – $2,000 |

Note: These are estimated averages and can vary significantly based on specific circumstances.

Policy Changes and Updates in California Liability Insurance 2024: Liability Insurance Trends 2024 California

Seismic shifts are reshaping California’s liability insurance landscape in 2024. Policyholders face a complex interplay of legislative mandates and evolving market pressures, necessitating a proactive approach to navigate the altered terrain. The insurance industry is reacting to evolving societal needs and risks, resulting in nuanced adjustments to policies and coverage.Recent legislative actions and regulatory pronouncements have dramatically impacted the structure and scope of liability insurance products.

This necessitates a deep dive into the specifics of these changes to ensure informed decision-making for policyholders. Understanding the implications of these modifications is crucial for protecting assets and minimizing financial vulnerability.

Recent Policy Changes Affecting Coverage

Policy updates often involve adjustments to the specific perils covered, limits of liability, and deductibles. These modifications aim to better reflect current risk profiles and societal needs. A significant change in 2024 involves an expansion of coverage for certain environmental liabilities, recognizing the increasing risk associated with climate change and its consequences. This means broader protection for policyholders dealing with issues like hazardous waste cleanup.

Similarly, policy terms now include more explicit clauses regarding coverage for cyber-attacks, a growing concern for businesses in the digital age.

Impact of Legislative Actions on Insurance Products

California’s legislative framework has a direct impact on the design and availability of liability insurance products. Recent legislation has mandated changes to the way insurers assess and calculate premiums, potentially leading to fluctuations in rates. This adjustment reflects a legislative commitment to fairness and equitable access to insurance, and the effect is felt by all policyholders. The introduction of specific mandates for coverage of certain catastrophic events (such as wildfires) has also influenced the design of insurance policies.

For example, policies now require a broader range of coverage for wildfire damage, exceeding traditional property damage clauses.

Changes to Policy Terms and Conditions

Policy terms and conditions have been updated to reflect the evolving regulatory landscape. This involves changes to notice requirements, claims procedures, and the extent of insurer responsibility. A notable update pertains to the clarification of the burden of proof in claims disputes. Insurers are now obligated to provide more detailed explanations of their decision-making processes in claims, ensuring transparency and potentially reducing disputes.

Policyholders are encouraged to review these changes meticulously to understand their rights and obligations under the new policy.

Adapting to Updated Policy Changes

Policyholders must adapt to these updates to maintain adequate protection. This necessitates a proactive approach, involving thorough review of policy documents, understanding new coverage limitations, and ensuring compliance with revised claims procedures. Reviewing the policy frequently and asking clarifying questions from insurers is essential for comprehension. Understanding new coverage limitations and claims procedures is crucial to avoid unexpected financial consequences.

Obtaining Updated Policy Documents

Policyholders can access updated policy documents through various channels. The most direct method is typically through the insurer’s online portal, accessible via a secure login. Insurers are also required to make updated documents available on their websites. Contacting the insurance agent or broker is another avenue for acquiring the updated policy documentation. Directly requesting a copy of the updated policy is also a viable option.

Key Policy Changes and Their Implications, Liability insurance trends 2024 california

| Policy Change | Implications for Different Policyholders |

|---|---|

| Expanded coverage for environmental liabilities | Increased protection for businesses operating in environmentally sensitive areas; enhanced coverage for property damage arising from climate-related events. |

| Mandated coverage for cyber-attacks | Essential for businesses reliant on digital infrastructure; crucial for protecting sensitive data and preventing financial losses. |

| Changes to premium calculation methods | Potential for rate fluctuations; policyholders should monitor rate changes and consider alternative insurance options. |

| Clarified claims procedures | Increased transparency for policyholders; reduced likelihood of disputes. |

Future Outlook for Liability Insurance in California 2024

The California liability insurance landscape in 2024 is poised for a dramatic evolution, a turbulent sea of shifting currents driven by technological advancements, evolving societal norms, and the relentless march of litigation. Predicting the precise trajectory is a challenging endeavor, but the winds of change are unmistakable. The coming years promise a fascinating interplay of forces, shaping the cost, availability, and very nature of coverage.The future of liability insurance in California is inextricably linked to the broader economic and societal trends.

Inflationary pressures, coupled with increasing claims frequency and severity, will exert a significant influence on premium structures. Moreover, the rise of alternative dispute resolution methods and the increasing use of technology to manage claims will reshape the industry’s operational dynamics. The state’s regulatory environment, including potential legislative changes, will also play a pivotal role in defining the contours of the liability insurance landscape.

So, like, liability insurance in Cali for 2024 is lookin’ kinda wild, you know? Gotta stay on top of those trends, especially if you’re planning a trip, like maybe the amazing Sian Ka’an biosphere tour. Sian Ka’an biosphere tour sounds epic, right? But seriously, it’s crucial to know the ins and outs of insurance for any outdoor adventures.

Keeping up with the California 2024 liability insurance trends is key, no cap.

Probable Trajectory of Liability Insurance Trends

The probable trajectory of liability insurance trends in California suggests a complex interplay of factors. Increased litigation costs, coupled with a rising number of complex claims (e.g., cyber liability, autonomous vehicle incidents, and evolving environmental concerns), will likely lead to upward pressure on premiums. The current climate of uncertainty surrounding policy renewals, combined with a potential reduction in available insurers, will further intensify these pressures.

The industry’s response will be multifaceted, encompassing technological innovations, risk assessment methodologies, and potentially, a reevaluation of coverage limits and types.

Potential Impact of Industry Developments

Industry developments will significantly impact liability insurance in California. The rise of autonomous vehicles, for example, presents novel liability challenges, demanding new approaches to insurance coverage. The increasing sophistication of cyber threats will necessitate expanded cyber liability coverage, forcing insurers to adapt their risk models and policy structures. Furthermore, the growing prevalence of environmental claims related to climate change and pollution will influence policy design and pricing strategies.

Anticipated Shifts in Coverage and Pricing Models

Significant shifts in coverage and pricing models are anticipated. Insurers are likely to implement dynamic pricing models that account for individual risk profiles more precisely. This will entail a greater emphasis on data analytics and sophisticated risk assessment tools. Furthermore, a surge in demand for specialized liability coverage, such as professional liability for emerging industries (e.g., AI, renewable energy), will prompt insurers to develop tailored products.

Comprehensive Outlook for Liability Insurance

The overall outlook for liability insurance in California is one of dynamic change. While rising costs and limited availability will likely persist, innovative solutions will emerge. The industry will increasingly leverage technology to streamline claims processes, enhance risk management, and potentially offer more affordable premiums for compliant and responsible policyholders.

Expected Trends for Coverage Limits and Types of Claims

Coverage limits are projected to remain a significant point of contention. Policyholders may experience difficulty obtaining coverage for emerging risks, particularly those related to the digital economy. Claims related to property damage, bodily injury, and liability arising from technological failures or environmental catastrophes are expected to rise, demanding enhanced coverage limits and specialized endorsements.

Projected Liability Insurance Scenarios in California by 2025

| Scenario | Premium Trends | Coverage Availability | Claim Types |

|---|---|---|---|

| Scenario 1: Moderate Growth | Premium increases moderate, reflecting inflationary pressures and increased litigation. | Coverage availability remains stable, but some specialized coverage may become more difficult to obtain. | Claims related to property damage, bodily injury, and cyber incidents are expected to be prevalent. |

| Scenario 2: Rapid Inflation | Premium increases accelerate, driven by rising claims frequency and severity, and limited supply. | Coverage availability diminishes, especially for high-risk businesses and individuals. | Claims related to autonomous vehicle incidents, complex environmental issues, and professional negligence in emerging industries will increase. |

| Scenario 3: Regulatory Intervention | Premiums are stabilized or slightly reduced through regulatory oversight and market intervention. | Coverage availability remains relatively stable, with government programs or initiatives potentially increasing accessibility. | Claims involving traditional liability issues (e.g., premises liability, auto accidents) will continue, but the impact of evolving technologies will become increasingly significant. |

Final Conclusion

In conclusion, California’s liability insurance landscape in 2024 is a confluence of established norms and disruptive innovations. The interplay of regulatory changes, technological advancements, and economic factors creates a complex picture for both consumers and businesses. Navigating this evolving terrain requires a nuanced understanding of emerging trends, potential costs, and the future outlook. Ultimately, staying informed and proactively adapting to these shifts is paramount for securing appropriate coverage and mitigating potential risks.

Helpful Answers

What are the most significant regulatory changes impacting liability insurance in California in 2024?

Recent legislation in California has focused on increasing transparency in pricing models and expanding access to affordable coverage, particularly for underserved segments. Specific changes vary and depend on the type of liability insurance.

How are technological advancements affecting the provision of liability insurance in California?

Emerging technologies, such as AI and data analytics, are impacting risk assessment and pricing strategies. These tools can potentially lead to more personalized and efficient insurance solutions. The use of telematics and connected devices is also shaping the future of auto insurance, for instance.

What are the projected average premium increases for various liability insurance types in California in 2024?

Unfortunately, precise figures are not included in the provided Artikel. The average premium increases depend on numerous factors such as specific policy types, coverage limits, and individual risk profiles.

What are the potential insurance gaps or underserved segments in California’s liability insurance market in 2024?

Certain emerging industries or businesses, such as those operating in the gig economy or new technological fields, may face challenges in finding appropriate and affordable liability coverage. This is particularly true if traditional models do not adequately account for the evolving risks.