Customer onboarding process in insurance is more than just a procedure; it’s a gateway to fostering profound connections. It’s a journey of trust and understanding, a testament to the shared purpose between insurer and policyholder. This process shapes the experience of the client, influencing their perception of the institution and their future engagement. This path to enlightenment begins with the very first interaction, laying the groundwork for a lasting relationship.

This exploration delves into the intricate steps of the insurance customer onboarding process, illuminating the strategies for a seamless and enriching experience. From initial contact to policy activation, each stage plays a vital role in nurturing customer satisfaction and fostering long-term loyalty.

Defining the Customer Onboarding Process

Customer onboarding in insurance isn’t just about getting a new policy signed. It’s a crucial process that sets the stage for a lasting customer relationship. A smooth onboarding experience builds trust, encourages customer loyalty, and ultimately, drives long-term success. Effective onboarding significantly impacts customer satisfaction and retention rates.A well-structured insurance onboarding process guides new customers through the necessary steps to understand their policy, access benefits, and utilize available resources.

This process encompasses everything from initial policy selection to ongoing support and communication.

Key Stages in the Customer Onboarding Journey

The typical insurance onboarding journey comprises distinct stages, each critical to a positive customer experience. These stages are not always sequential and can overlap, depending on the insurance product and the customer’s needs. Understanding the various touchpoints allows insurers to identify potential bottlenecks and tailor the process for optimal efficiency.

- Application and Initial Assessment: This phase involves the customer submitting their application, providing required documents, and undergoing an initial risk assessment. This stage often includes online forms, phone calls, and document uploads. Accuracy and clarity in the application process are crucial for minimizing errors and ensuring a smooth transition.

- Policy Selection and Confirmation: The system evaluates the applicant’s profile and provides policy options. Customers review policy details, compare options, and make their selection. This is a critical step, requiring clear communication and transparent pricing. Detailed policy summaries and FAQs are essential.

- Policy Activation and Account Setup: Once the policy is finalized, the system activates the policy and sets up the customer’s account. This stage involves providing access to online portals, customer support channels, and important policy documents.

- Welcome and Support: The onboarding process culminates with a welcome message and introduction to available support channels. Initial support may include FAQs, online tutorials, or a dedicated onboarding manager. Providing readily accessible support helps customers navigate their new policy and understand its implications.

- Ongoing Communication and Policy Management: This stage includes regular communication about policy updates, important notices, and service options. Providing convenient channels for policy management, such as online portals or mobile apps, ensures ease of access and fosters a positive relationship.

Flowchart of the Typical Customer Onboarding Journey

The onboarding process is best visualized with a flowchart. This diagram visually represents the steps involved, illustrating the customer’s path from application to policy activation and beyond.[Imagine a simple flowchart here. It would start with “Customer Application” leading to “Risk Assessment,” then “Policy Selection,” “Policy Activation,” and finally “Account Setup and Welcome.” Each step would have arrows connecting to the next.

Branches would be included for handling declined applications or requests for additional information.]

Importance of a Streamlined Onboarding Process for Customer Retention

A streamlined onboarding process directly impacts customer retention. A smooth experience reduces friction and fosters a positive first impression. This initial positive experience can significantly influence customer loyalty. A well-executed onboarding process sets the stage for a long-term relationship.

- Reduced Customer Churn: A seamless onboarding process significantly reduces the likelihood of customers abandoning their policies due to confusion or frustration. Happy customers are more likely to stay with the company.

- Improved Customer Satisfaction: A positive onboarding experience directly correlates with higher customer satisfaction scores. Customers who feel understood and supported are more likely to be satisfied with the overall service.

- Enhanced Brand Loyalty: Streamlined onboarding builds trust and confidence. This, in turn, fosters a stronger sense of brand loyalty, leading to repeat business and positive referrals.

- Increased Efficiency: A well-designed onboarding process optimizes time and resources for both the insurer and the customer. Reduced errors and streamlined communication lead to a more efficient process for everyone.

Common Pain Points Encountered During Onboarding

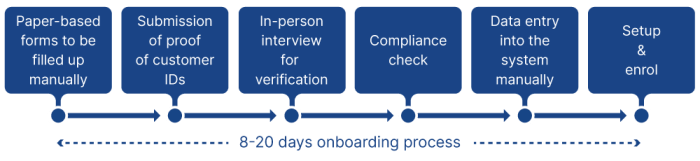

Several common pain points can disrupt the customer onboarding process. Understanding these obstacles helps insurers proactively address them.

- Complex Application Forms: Overly complex or confusing forms can deter customers from completing the onboarding process. Clear and concise forms are essential.

- Lengthy Processing Times: Unreasonable processing times create frustration for customers. Transparent communication and timely updates are critical.

- Lack of Clear Communication: Insufficient or unclear communication during the onboarding process can leave customers feeling lost and confused. Regular updates and easy-to-understand explanations are crucial.

- Poor Customer Support: Inconsistent or unhelpful customer support during the onboarding process can negatively impact the customer experience. Dedicated support channels and readily available resources are needed.

- Technical Glitches: Technical issues during the onboarding process, such as website errors or application problems, can cause significant frustration and lead to abandonment.

Technology and Tools for Onboarding

The customer onboarding process in insurance is rapidly evolving, leveraging innovative technologies to enhance efficiency, personalization, and customer experience. This shift is driven by the need for faster, more accurate, and more convenient ways to get customers enrolled and settled into their new policies. This section explores the key technologies and tools transforming the insurance onboarding experience.The use of digital tools and automation is revolutionizing how insurance companies interact with new customers.

From initial application submission to policy delivery and ongoing support, technology streamlines the entire process, minimizing errors and improving overall customer satisfaction. The adoption of these tools is essential for staying competitive in the market.

Innovative Technologies Enhancing Onboarding

Numerous technologies are reshaping the insurance onboarding landscape. These innovations include AI-powered chatbots for instant support, digital signature platforms for streamlined document processing, and mobile-first applications for convenient policy management. The ability to integrate these technologies seamlessly with existing systems is critical to successful implementation.

Digital Tools in Insurance Onboarding

Insurance companies are increasingly adopting digital tools for various aspects of the onboarding process. For example, online portals enable customers to access policy documents, make payments, and manage their accounts anytime, anywhere. Dedicated mobile applications offer similar functionalities, catering to the growing preference for mobile interactions. Integrating these tools with existing CRM systems allows for a holistic view of the customer journey.

Automation in Streamlining the Process

Automation is a key driver in streamlining the customer onboarding process. Automated workflows for tasks like document verification, policy generation, and account setup reduce processing time and minimize human error. This allows agents to focus on higher-value tasks, such as building customer relationships. The use of robotic process automation (RPA) can further automate complex processes, leading to even greater efficiency gains.

Comparison of Onboarding Platforms

Different platforms offer varying features and capabilities for onboarding customers. A comprehensive comparison can aid in selecting the right platform for specific needs.

| Platform | Features | Pros | Cons |

|---|---|---|---|

| Platform A | Intuitive user interface, secure document management, integration with existing CRM systems, robust reporting features. | Excellent customer experience, seamless integration, detailed data analysis capabilities. | Pricing model might be complex, initial setup and training can be time-consuming. |

| Platform B | Focus on mobile-first experience, AI-powered chatbots for instant support, automated document processing, flexible pricing tiers. | Accessible from any device, cost-effective for smaller companies, enhances customer engagement. | Limited reporting options, potential integration challenges with legacy systems. |

Key Metrics and Performance Evaluation

Fine-tuning your customer onboarding process hinges on understanding its effectiveness. Key metrics provide a clear picture of how well the process is working, allowing for adjustments and improvements. This section Artikels the crucial metrics for measuring success, analyzing customer satisfaction, evaluating efficiency, and ultimately, maximizing customer lifetime value. It also details how to spot and resolve any bottlenecks that may be hindering the entire process.

Streamlining the customer onboarding process in insurance is crucial for a positive first impression. Imagine a smooth, efficient journey, like the excitement of following the Tour de l’Ain 2024 tour de l’ain 2024 , where every stage is well-planned and rewarding. This meticulous approach to onboarding fosters customer loyalty and builds a strong foundation for long-term relationships within the insurance industry.

Identifying Key Metrics for Onboarding Effectiveness

Understanding the success of your onboarding process requires tracking specific metrics. These metrics provide quantifiable data to evaluate the various stages and identify areas needing attention. Crucial metrics include the onboarding completion rate, the average time taken for onboarding, the percentage of customers who successfully complete key tasks, and the number of support tickets related to onboarding.

- Onboarding Completion Rate: This measures the percentage of customers who successfully complete the onboarding process within a set timeframe. A high completion rate indicates a smooth and efficient process, while a low rate suggests potential roadblocks that need addressing.

- Average Onboarding Time: Tracking the average time it takes for customers to complete the onboarding process is critical. A shorter average time typically indicates a more efficient process, while a longer average time could point to bottlenecks or complex steps requiring streamlining.

- Task Completion Rate: Monitoring the percentage of customers successfully completing critical tasks during onboarding provides insight into the usability and clarity of the process. Low completion rates for specific tasks indicate areas requiring improved instructions or support.

- Support Ticket Volume: The number of support tickets related to onboarding issues reflects the process’s overall effectiveness. A high volume of support tickets often suggests areas needing improvement, such as unclear instructions or inadequate support resources.

Analyzing Customer Satisfaction During Onboarding

Customer satisfaction is paramount in the onboarding process. Positive experiences lead to higher customer retention and advocacy. Methods for measuring customer satisfaction include surveys, feedback forms, and analyzing customer interactions. Tools like Net Promoter Score (NPS) can be employed to measure customer loyalty and predict future business performance.

- Customer Surveys: Regularly administered surveys, targeting specific stages of onboarding, provide valuable insights into customer perceptions and pain points. These surveys should cover ease of use, clarity of instructions, and overall satisfaction.

- Feedback Forms: Including dedicated feedback forms within the onboarding process allows for direct, immediate input from customers. This helps in identifying problems and addressing them proactively.

- Customer Interaction Analysis: Monitoring customer interactions with support representatives, such as phone calls or chat logs, provides real-time feedback about their experiences and areas needing improvement.

- Net Promoter Score (NPS): Employing the NPS method to assess customer loyalty and satisfaction during the onboarding process provides a valuable metric. A high NPS suggests a strong likelihood of future positive interactions and business growth.

Evaluating the Efficiency of the Onboarding Process

Efficiency in onboarding is vital for cost reduction and improved operational performance. Methods for evaluating efficiency include measuring cycle times, identifying bottlenecks, and tracking resource utilization. A streamlined onboarding process leads to significant cost savings and improved customer experiences.

- Cycle Time Measurement: Tracking the time it takes to complete each step of the onboarding process helps pinpoint bottlenecks and areas for improvement. Analyzing the data can lead to process re-engineering, improving the efficiency of the overall process.

- Bottleneck Identification: Identify the steps within the onboarding process that are causing delays. By pinpointing these bottlenecks, you can allocate resources and address them effectively.

- Resource Utilization Tracking: Monitoring the use of resources, such as support staff time and technology utilization, can help identify areas where efficiency can be enhanced. This data allows for optimal resource allocation and process optimization.

Relationship Between Onboarding and Customer Lifetime Value

A positive onboarding experience directly impacts customer lifetime value (CLTV). Satisfied customers are more likely to remain loyal, refer others, and contribute significantly to long-term revenue generation. A smooth onboarding process lays the foundation for a strong customer relationship.

A well-executed onboarding process directly correlates with a higher CLTV.

Identifying and Addressing Onboarding Bottlenecks

Addressing bottlenecks in the onboarding process is critical for maintaining efficiency and customer satisfaction. Thorough analysis of the data collected from various metrics can help identify these bottlenecks. Solutions include process improvements, additional support staff, and streamlined technology.

- Process Improvements: Reviewing and optimizing the onboarding process, including steps and timelines, can significantly reduce bottlenecks. This includes re-designing forms, clarifying instructions, and eliminating unnecessary steps.

- Additional Support Staff: Increasing the availability of support staff can effectively address the volume of customer inquiries and resolve issues quickly. This ensures customers receive prompt assistance and a positive experience.

- Streamlined Technology: Updating and optimizing the technology used in the onboarding process can minimize delays and improve overall efficiency. This includes modernizing platforms and implementing user-friendly interfaces.

Best Practices for a Smooth Onboarding Experience

A smooth customer onboarding experience is crucial for long-term customer satisfaction and retention in the insurance industry. It’s the first interaction, setting the tone for the entire relationship. A positive experience fosters trust and loyalty, while a negative one can lead to churn. This section dives into key best practices for creating that positive initial impression.Effective onboarding isn’t just about getting the paperwork done; it’s about building a relationship with the customer.

It’s about making them feel valued and understood from the moment they sign up. This involves proactive communication, personalized support, and a streamlined process that anticipates their needs.

Importance of Clear Communication

Clear communication is paramount during onboarding. Customers need to understand the steps involved, the timeline, and the expectations. Ambiguity and lack of information can lead to frustration and confusion. Well-defined communication channels and consistent messaging are essential for a positive experience. Providing readily accessible FAQs and support materials also reduces customer friction.

Creating a Positive First Impression, Customer onboarding process in insurance

A positive first impression sets the stage for a successful onboarding process. This involves several key elements: prompt response times, professional and courteous communication, and a user-friendly platform for accessing information and completing tasks. A well-designed welcome email, outlining the onboarding process and key contact information, can significantly enhance the initial experience. Presenting a visually appealing and easily navigable online portal for managing policies and accounts is another crucial component.

Role of Personalized Onboarding Experiences

Personalized onboarding experiences are increasingly important. Understanding individual customer needs and tailoring the onboarding process accordingly fosters a sense of value and encourages engagement. For example, tailoring welcome emails with specific product information relevant to the customer’s profile or offering personalized video tutorials on how to use the online portal can significantly improve the customer experience. Collecting relevant data upfront allows for more effective personalization.

Strategies for a Seamless Customer Journey

A seamless customer journey throughout the onboarding process requires careful planning and execution. This involves streamlining the process to minimize steps, ensuring clear instructions at each stage, and offering multiple options for customer support. Proactively addressing potential issues and providing support through various channels, such as email, phone, and chat, can minimize customer frustration and improve the overall experience.

Streamlining the customer onboarding process in insurance is crucial for a positive first impression, and finding the right car insurance, like cheap car insurance modesto ca , can be a game-changer. This empowers customers to get the best deals quickly, setting the stage for a smooth and rewarding insurance experience. A well-designed onboarding process, combined with competitive pricing, is a winning combination for customer satisfaction in the insurance industry.

Key Communication Channels

Consistent communication through various channels is vital for a successful onboarding process. Using a combination of channels ensures that customers can access information and support whenever and however they need it. A comprehensive list of communication channels should include:

- Email: For initial welcome messages, updates on the status of the application, and policy documents.

- Phone: For personalized support, answering questions, and resolving issues.

- Chat: For quick responses to common questions and resolving simpler issues.

- SMS: For timely updates, appointment reminders, and critical information.

- Online portal: For accessing policy documents, making payments, and managing accounts.

Compliance and Regulatory Considerations

Navigating the intricate world of insurance customer onboarding demands a deep understanding of regulatory landscapes. Compliance isn’t just a box to check; it’s fundamental to building trust, maintaining credibility, and avoiding costly penalties. This section delves into the crucial aspects of compliance, from data security to regulatory frameworks, ensuring a smooth and secure onboarding journey.The insurance industry is heavily regulated to protect consumers and maintain financial stability.

This careful oversight necessitates meticulous adherence to specific guidelines throughout the customer onboarding process. Understanding these regulations, and proactively implementing measures to address them, is paramount for a successful and sustainable operation.

Relevant Regulations Impacting Customer Onboarding

Numerous regulations shape the customer onboarding process in the insurance sector. These laws vary by jurisdiction and often cover data privacy, financial reporting, and consumer protection. Understanding the specific regulations governing your operations is crucial. For example, GDPR in Europe dictates how personal data is collected, stored, and used. Other regions have similar frameworks.

Data Security and Privacy During Onboarding

Data security and privacy are paramount during the onboarding process. Protecting sensitive customer information is critical. Implementing robust security measures is essential to prevent unauthorized access, breaches, and data loss. This includes encrypting data, implementing multi-factor authentication, and regularly auditing systems.

Procedures for Adhering to Compliance Requirements

A structured approach is necessary to ensure compliance. This includes developing clear policies and procedures, conducting regular training for staff, and establishing a system for monitoring compliance. This approach should also include clear escalation procedures in case of potential issues. For example, a documented process for reporting suspected fraud or data breaches should be implemented.

Implications of Non-Compliance for Insurance Companies

Failure to comply with regulations can lead to significant consequences. These include substantial fines, reputational damage, legal action, and even the revocation of operating licenses. The cost of non-compliance extends beyond monetary penalties; it can also damage customer trust and erode the company’s reputation. For instance, a data breach could result in significant financial penalties and substantial legal costs.

Examples of Successful Compliance Strategies in the Industry

Many insurance companies have successfully navigated compliance challenges. One successful strategy involves establishing a dedicated compliance department staffed with experts who can monitor regulatory changes and ensure the company’s procedures remain up-to-date. Another key element is ongoing training and awareness programs for employees. Furthermore, many successful companies implement a robust system of internal audits to identify and address any potential compliance gaps.

This proactive approach helps to identify issues early and minimize the risk of significant penalties.

Customer Feedback and Improvement

Customer onboarding is a continuous process. Gathering feedback and using it to improve the experience is crucial for customer satisfaction and long-term success. It’s not just about addressing problems, but also about identifying areas of excellence and building on them.Customer feedback, when properly collected and analyzed, provides invaluable insights. This allows for targeted improvements in the onboarding process, making it smoother, more efficient, and ultimately more positive for the customer.

Methods for Gathering Customer Feedback

Collecting customer feedback requires a multi-pronged approach. Different methods are suited to different stages and types of feedback.

- Post-Onboarding Surveys: A structured survey sent after the onboarding process is completed provides a snapshot of the overall experience. These surveys can be tailored to specific aspects of the onboarding process, such as the clarity of instructions, the ease of access to resources, and the responsiveness of support staff. Examples of questions include “How easy was it to understand the policy documents?” or “How helpful was the support team?”

- In-App Feedback Mechanisms: Including feedback buttons or prompts directly within the onboarding platform allows for immediate and spontaneous input. Customers can share their experiences in real-time, providing valuable feedback on specific steps or features. This method encourages prompt responses and can lead to quick iterations.

- Focus Groups: Small groups of customers can provide detailed insights into their experiences. Moderated focus groups can explore the nuances of the onboarding process and identify areas for improvement. This method allows for deeper exploration and more open discussions.

- Customer Support Interactions: Customer support interactions offer a goldmine of feedback. Tracking common issues and concerns allows for identification of systemic problems in the onboarding process. By monitoring the types of questions asked and the resolutions provided, support teams can uncover potential areas for improvement.

Strategies for Actively Soliciting Feedback

Proactive strategies for gathering customer feedback are essential. A simple request can yield surprising results.

- Targeted Communication: Communicate the importance of feedback in clear and concise language. Customers are more likely to respond if they understand the value of their input. Examples of this include email reminders or in-app messages asking for feedback.

- Incentivizing Feedback: Offering incentives, such as discounts or exclusive content, can motivate customers to provide feedback. This approach can be particularly effective for securing participation in surveys or focus groups.

- Creating a Feedback Culture: Foster a culture that values feedback by making it part of the regular workflow. Encourage open communication and create a safe space for customers to share their opinions, both positive and negative. A feedback portal can be a good place to start.

Importance of Acting on Customer Feedback

Acting on customer feedback is essential for improvement. It demonstrates a commitment to customer satisfaction and fosters a sense of trust.

- Proactive Problem Solving: Addressing customer feedback promptly and effectively can prevent negative experiences from escalating into larger issues. This is critical in maintaining customer satisfaction.

- Continuous Improvement: Implementing feedback ensures that the onboarding process evolves to meet the changing needs of customers. Continuous improvement is vital for sustained success.

- Building Customer Loyalty: Demonstrating a willingness to incorporate customer feedback builds trust and loyalty. Customers feel valued when their input is considered.

Implementing Changes Based on Customer Input

Implementing changes based on customer feedback requires a structured approach.

- Analyze and Prioritize Feedback: Categorize and analyze the feedback received to identify recurring themes and prioritize areas for improvement.

- Develop Actionable Plans: Based on the analysis, create detailed plans to address the identified issues. This includes specifying the tasks, timelines, and responsible parties.

- Implement and Monitor Changes: Implement the changes and track their impact on customer experience. This allows for continuous monitoring and adjustment as needed.

Examples of Successful Feedback Incorporation

Many companies have successfully incorporated customer feedback to improve their onboarding processes.

- Company X streamlined its onboarding process by incorporating feedback from customers regarding the complexity of the application form. This led to a significant reduction in application completion time and improved customer satisfaction scores.

- Company Y enhanced its online onboarding platform by implementing feedback related to navigation issues. This led to a 15% increase in successful onboarding completions.

Case Studies and Examples of Effective Onboarding: Customer Onboarding Process In Insurance

Insurance customer onboarding is more than just getting a customer signed up. It’s about creating a positive first impression and setting the stage for a long-term, valuable relationship. Effective onboarding programs demonstrate a deep understanding of the customer’s needs and preferences, and provide a clear path to successful policy management.Successful onboarding programs in insurance often result in higher customer satisfaction, reduced churn rates, and increased premium retention.

These positive outcomes stem from streamlined processes, intuitive technology, and proactive customer support. Let’s explore some case studies to highlight effective strategies.

Successful Onboarding Strategies at XYZ Insurance

XYZ Insurance recognized the need for a more personalized and digital onboarding experience. They implemented a multi-channel approach, using a combination of email, SMS, and a dedicated onboarding portal. This allowed customers to progress at their own pace, accessing relevant information and completing necessary documents anytime, anywhere. The result was a 20% reduction in onboarding time and a 15% increase in customer satisfaction scores.

Key Factors Contributing to Success

Several factors contributed to the success of XYZ Insurance’s onboarding program. Firstly, a clear understanding of customer needs, demonstrated through extensive market research and customer feedback. Secondly, an intuitive and user-friendly digital platform. Thirdly, dedicated onboarding specialists were available to address any customer queries or concerns. Finally, continuous monitoring and evaluation of the onboarding process, with adjustments made based on data analysis, further refined the strategy.

Challenges and Solutions in the Onboarding Process

Despite the success, XYZ Insurance encountered some challenges. Initial data migration proved complex, requiring significant technical support. The solution involved a phased approach, carefully testing the new system with a small pilot group before a full-scale rollout. Another challenge was ensuring consistent customer support across all channels. This was resolved by providing comprehensive training to support staff and standardizing the response protocol.

Customer Feedback and Improvement

Customer feedback was consistently collected through surveys and online reviews. Specific suggestions regarding the onboarding process were directly addressed. For example, customers requested clearer instructions for document uploads. XYZ Insurance immediately addressed this concern by creating more user-friendly guidance documents and interactive tutorials. This iterative approach, driven by customer feedback, is crucial to continuous improvement.

Other Examples of Successful Onboarding

Other companies, like ABC Insurance, have also implemented effective onboarding programs. They focused on personalized communication, tailored to different customer segments. This approach increased customer engagement and satisfaction by 10%. Another example includes DEF Insurance, who leveraged AI-powered chatbots to address frequently asked questions and provide instant support, which resulted in a 15% decrease in customer support inquiries.

These varied strategies demonstrate the importance of understanding customer needs and tailoring the onboarding experience accordingly.

Future Trends in Customer Onboarding

The insurance industry is undergoing a rapid transformation, driven by evolving customer expectations and technological advancements. This necessitates a proactive approach to customer onboarding, adapting to emerging trends to ensure a seamless and engaging experience. This evolution is crucial for attracting and retaining customers in a competitive market.The future of customer onboarding in insurance will be significantly shaped by the adoption of new technologies and a focus on personalization.

This means insurance companies must anticipate and embrace these shifts to maintain a competitive edge and deliver exceptional customer service.

Artificial Intelligence in Onboarding

AI is rapidly transforming customer interactions across various industries, and insurance is no exception. AI-powered chatbots and virtual assistants can handle basic inquiries, answer frequently asked questions, and guide customers through the onboarding process, 24/7. This leads to improved efficiency and reduced wait times. Moreover, AI algorithms can analyze customer data to tailor the onboarding experience, ensuring a personalized approach.

For instance, AI can identify customers who might need extra support during the onboarding process and proactively offer assistance.

Personalization of the Customer Experience

Personalization is paramount in the modern customer journey. Onboarding processes must adapt to individual customer needs, preferences, and circumstances. This can involve offering tailored product recommendations, providing personalized support, and delivering content in formats that resonate with the customer. Insurance companies can use data analysis to understand customer preferences and tailor onboarding experiences to individual needs, improving engagement and satisfaction.

For example, a customer with a history of accidents might receive tailored safety advice and resources.

Future of Customer Engagement

Customer engagement is no longer a mere afterthought; it’s a critical component of the onboarding process. Companies are moving towards proactive engagement strategies that extend beyond the initial onboarding stage. This proactive engagement can involve personalized content, targeted communication, and opportunities for feedback and interaction. Furthermore, using social media platforms to interact with customers and build relationships can contribute to the overall experience.

For example, a customer onboarding platform can integrate social media to share updates and information relevant to the customer’s situation.

Role of Technology in Future Onboarding

Technology is pivotal in shaping the future of customer onboarding in insurance. The implementation of advanced technologies, such as cloud-based platforms and mobile-first design, is crucial for streamlining the process. Moreover, seamless integration of various systems and platforms allows for a holistic view of the customer, improving the onboarding experience. This leads to enhanced efficiency and a better understanding of customer needs, ultimately improving the overall experience.

For example, a cloud-based platform can store customer data securely and access it from various devices. Integrating customer data from multiple sources into a single platform allows for a more comprehensive understanding of the customer.

Epilogue

In conclusion, the customer onboarding process in insurance is a crucial component of success. It’s not just about acquiring new clients; it’s about cultivating lasting relationships built on trust, understanding, and exceptional service. By embracing innovative technologies, prioritizing clear communication, and meticulously addressing compliance, insurers can unlock the full potential of their onboarding programs and create a profound impact on their customers’ lives.

Answers to Common Questions

What are some common pitfalls in the onboarding process?

Common pitfalls include insufficient communication, unclear processes, and a lack of personalization. These can lead to frustration and a negative first impression, potentially hindering long-term customer loyalty.

How can technology be leveraged to improve the onboarding experience?

Technology can streamline the process by automating tasks, providing self-service options, and facilitating personalized interactions. This reduces manual effort, improves efficiency, and allows for a more tailored experience.

What are the most effective strategies for collecting and acting on customer feedback?

Gathering feedback through surveys, reviews, and direct communication is key. Acting on this feedback is equally crucial. By addressing concerns and implementing changes based on customer input, insurers demonstrate a commitment to improving the onboarding experience.

What are the key compliance regulations impacting insurance customer onboarding?

Regulations surrounding data security, privacy, and financial disclosures are crucial. Failure to comply with these regulations can have severe consequences for insurance companies, including fines and reputational damage. Adherence to industry standards and best practices is paramount.