Prudential long-term care insurance reviews offer a critical look at policies, highlighting both the strengths and weaknesses of this crucial coverage. This in-depth analysis examines consumer experiences, policy costs, coverage details, and the claims process, aiming to provide a clear picture for prospective buyers.

The guide delves into Prudential’s history in the long-term care insurance market, comparing their policies with competitors. It also analyzes customer reviews, dissecting positive and negative experiences to give a complete picture of the insurer’s performance. Key factors such as policy features, costs, and claims processes are also meticulously reviewed.

Introduction to Long-Term Care Insurance

Long-term care insurance (LTCI) is a crucial financial tool, especially as you navigate the complexities of aging. It’s a type of insurance that can help pay for the costs of long-term care services, like nursing homes or in-home assistance, if you become unable to care for yourself. Think of it as a safety net, ensuring your financial well-being if you need extensive care.LTCI policies offer coverage for a variety of care services.

They’re designed to provide financial support during a time when traditional income sources might not be enough. It’s essential to understand the different types of policies and their specific benefits to make an informed decision.

Common Types of LTCI Policies

Different LTCI policies cater to varying needs and financial situations. Understanding these types helps you choose the right coverage.

- Traditional Policies: These policies often provide benefits in a lump sum or as a monthly payment. They typically have a set daily or monthly benefit amount, and the length of coverage can vary. Premiums are often fixed, but the coverage amount may adjust based on inflation.

- Hybrid Policies: Combining elements of traditional and other insurance types, hybrid policies often offer flexibility. Some may include riders that add supplemental benefits, such as coverage for certain medical conditions or specific care settings. Premium structures can be more complex than traditional policies, potentially requiring a deeper analysis of individual needs.

- Accelerated Benefits Policies: These policies are designed for those with specific health concerns, potentially offering benefits sooner than traditional policies. They often come with specific eligibility requirements and limitations on the types of care they cover. These can be a vital option for those with anticipated future health needs.

Key Factors to Consider When Choosing an LTCI Policy

Choosing the right LTCI policy requires careful consideration of several factors. A well-informed decision will ensure the policy aligns with your financial goals and personal circumstances.

- Coverage Amount: This is a crucial aspect, as the amount of coverage should adequately address potential long-term care costs. Consider average costs for care in your area and potential inflation. A policy that covers the cost of a private room in a nursing home, for example, would be a good start.

- Premiums: LTCI premiums vary significantly depending on the type of policy, coverage amount, and your age. Understanding the premium structure and its impact on your budget is essential. Shop around to find policies that fit within your financial constraints.

- Policy Riders: Riders can add specific benefits to your policy, like coverage for certain conditions or care settings. Assess if the added benefits are worth the potential increase in premiums.

- Length of Coverage: Policies typically provide coverage for a set period. Evaluate how long you anticipate needing long-term care, and choose a policy with a duration that meets your needs.

Policy Benefits and Limitations

Understanding the benefits and limitations of an LTCI policy is paramount.

| Benefit | Limitation |

|---|---|

| Financial security during a critical period | Premiums can be substantial and may affect current finances. |

| Potential for significant savings in healthcare costs | Policy exclusions can affect coverage, and not all care is covered. |

| Peace of mind in knowing your needs are protected | Coverage amounts may not always cover all potential costs. |

A well-chosen LTCI policy can act as a significant financial buffer during challenging times, ensuring your needs are met. It’s a smart investment in long-term security.

Understanding Prudential Long-Term Care Insurance: Prudential Long-term Care Insurance Reviews

Prudential, a name synonymous with financial security, offers long-term care insurance (LTCI) to help navigate the often-unforeseen costs of aging. This comprehensive look delves into Prudential’s history within the LTCI market, exploring their policy offerings and positioning them against competitors.Prudential’s long-standing presence in the financial sector lends credibility to their LTCI products. Their experience and resources allow them to offer a variety of plans, catering to different needs and budgets.

However, it’s crucial to compare various policies to ensure they align with your specific requirements.

Prudential’s History and Reputation in the LTCI Market, Prudential long-term care insurance reviews

Prudential boasts a rich history in the insurance industry, translating into substantial experience in the LTCI sector. Their reputation hinges on a commitment to providing comprehensive coverage options. This reputation, however, is only as good as the policies they offer and how they adapt to evolving care needs.

Prudential’s LTCI Policy Offerings

Prudential offers a range of LTCI policies, each designed to address specific requirements. These policies often vary in terms of benefits, premiums, and eligibility criteria. Understanding these differences is vital to selecting a plan that aligns with your individual circumstances.

- Guaranteed Renewable Policies: These policies allow you to renew your coverage without any change in premiums, assuming your health remains stable. This feature offers stability and peace of mind, particularly in the long run. Many policies, however, include provisions that can affect premiums over time.

- Catastrophic Care Plans: Designed for individuals facing severe, chronic health conditions requiring extensive care, these plans provide comprehensive coverage for a wide range of services, including skilled nursing care, assisted living, and home healthcare. However, the scope of care may be limited depending on the specific policy.

- Hybrid Policies: These policies combine aspects of both guaranteed renewable and non-guaranteed renewable options, offering a balance between stability and flexibility. These plans are more adaptable to individual circumstances and can be tailored to better meet your needs.

Comparing Prudential’s LTCI Policies with Competitors

A crucial aspect of choosing LTCI is evaluating various insurers. Prudential’s policies should be compared against other prominent players in the market to understand their value proposition.

| Feature | Prudential | Major Competitor A | Major Competitor B |

|---|---|---|---|

| Premiums | Competitive, varying by policy and coverage | Competitive, with potential for higher premiums in some cases | Often lower initial premiums but can increase over time |

| Benefits | Comprehensive coverage options | Strong focus on specific needs, like Alzheimer’s care | Extensive network of providers |

| Eligibility | Typically includes various health conditions | May have stricter eligibility criteria for certain conditions | Generally more lenient with age restrictions |

A thorough comparison is essential for selecting the best LTCI policy, factoring in individual needs and financial situations.

Analyzing Reviews and Consumer Experiences

Scrutinising customer feedback on Prudential’s long-term care insurance (LTCI) policies reveals a mixed bag, offering valuable insights into the product’s strengths and weaknesses. Digging into these reviews, we can identify recurring patterns in both praise and complaints, helping to paint a clearer picture of the policy’s appeal and potential pitfalls.

Positive Aspects of Prudential LTCI Policies

Customer feedback consistently highlights the straightforwardness of the policy application process. Many find the online portal user-friendly, making the entire process less daunting than anticipated. Reviews also commend the comprehensiveness of the policy documents, often praised for clearly outlining benefits and exclusions. This clarity helps customers make informed decisions and avoid future misunderstandings.

Scrutinizing Prudential’s long-term care insurance reviews reveals a complex picture of policy options and customer experiences. Many policyholders praise the company’s extensive coverage, while others express concerns about pricing and claim processing. This year’s vibrant extravaganza, the jelly belly candy palooza 2024 , highlights the sheer volume of choices available, similar to the wide range of plans offered by Prudential.

Ultimately, thorough research and careful consideration are key when evaluating long-term care insurance policies, regardless of the company or the sugary treats on offer.

- Ease of Application: Many reviewers found the online application process intuitive and quick, allowing them to complete the application without extensive assistance.

- Clear Policy Documents: The clarity and comprehensiveness of policy documents were consistently lauded, enabling customers to grasp the coverage and exclusions without undue difficulty. This transparent approach fosters customer trust and satisfaction.

- Competitive Premiums: In some cases, reviewers praised Prudential’s competitive premiums relative to other LTCI providers, highlighting a balance between affordability and coverage.

- Responsive Customer Service: While not a dominant theme, some positive feedback pointed to prompt and helpful responses from customer service representatives during inquiries.

Common Complaints Regarding Prudential LTCI Policies

Despite positive aspects, common grievances surface regarding policy limitations and the claims process. Several reviewers expressed concerns about the limited coverage options available under certain plans, which, for some, might not align with their specific care needs. There are also recurring issues with the claims process, particularly regarding delays and difficulties in obtaining approvals.

- Limited Coverage Options: Some policies have been criticised for offering insufficient coverage options, potentially falling short of the comprehensive care needs of some customers. Review analysis suggests this deficiency is particularly apparent in policies targeted at specific age groups or health conditions.

- Delays in Claims Processing: A frequent complaint concerns lengthy delays in the claims approval process, causing financial strain and anxiety for policyholders facing potential care needs. This is often a significant concern, potentially impacting the viability of the policy.

- Complex Claims Process: Reviews frequently cite the complexity of the claims process, including navigating the paperwork and documentation requirements. This complexity can be a barrier to timely claim approvals, and may deter some customers from pursuing claims.

- Limited Flexibility in Care Options: Some reviewers expressed dissatisfaction with the limited flexibility offered in choosing care providers or locations, potentially hindering the ability to access appropriate care.

Recurring Themes in Positive and Negative Reviews

A recurring theme in both positive and negative feedback revolves around the importance of transparency and clarity. Positive reviews often cite clear policy language and accessible application processes, while negative reviews frequently point to opaque claims procedures and confusing coverage details.

Evaluating Policy Costs and Coverage

Navigating the cost labyrinth of long-term care insurance (LTCI) can feel like trying to find a needle in a haystack. Prudential, a heavyweight in the industry, offers a range of policies, but deciphering the value proposition takes some street smarts. Understanding the pricing structure and coverage options is crucial for making an informed decision.Prudential’s LTCI policies, like those from other providers, are tailored to different financial situations and desired levels of protection.

The cost of coverage is heavily influenced by factors like your age, health, and the specific benefits you choose. Comparing Prudential’s offerings with competitors requires a careful eye for detail, ensuring you’re not getting ripped off.

Pricing Structure Comparison

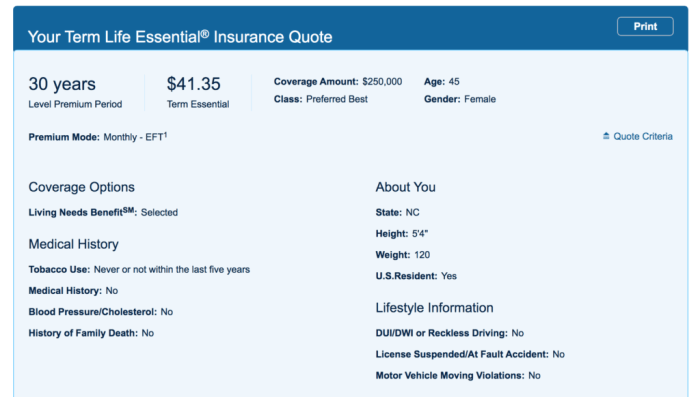

Prudential’s pricing, like other insurers, is influenced by various factors. Premiums depend heavily on your age at purchase. Younger applicants typically face lower premiums, reflecting the lower risk of needing long-term care in the future. A 30-year-old purchasing a policy will likely pay less than a 60-year-old, all else being equal. This age-based premium structure reflects the actuarial calculations insurers use to predict future costs.

Furthermore, the chosen benefit amount significantly impacts the monthly cost. Higher benefit amounts typically lead to higher premiums, mirroring the greater financial responsibility the insurer assumes. A comparison with competitors should consider these factors to gain a proper understanding of the cost structure.

Coverage Options Within Prudential Plans

Prudential’s LTCI policies provide a spectrum of coverage options. The core of these options typically centres around daily benefit amounts and the maximum duration of care covered. Different plans allow for various benefit amounts, reflecting the varying levels of care and expenses individuals might face. For instance, a plan might offer $150 per day for skilled nursing facility care, while another might provide $250.

Furthermore, the maximum coverage period also varies. This duration of care dictates the length of time the insurance will pay benefits, thus directly impacting the policy’s total value.

Addressing Different Needs and Circumstances

Prudential’s LTCI policies aren’t a one-size-fits-all solution. They cater to different needs and circumstances by offering various add-on options. For example, some policies might include inflation protection, which adjusts the daily benefit amount to account for rising costs of care over time. This adjustment protects against the eroding purchasing power of the benefits. Similarly, some policies might allow for supplemental care like home health aides, physical therapy, or other forms of support, tailoring the coverage to specific individual requirements.

Finally, the option of lifetime benefits provides a degree of security and predictability, but often comes with a higher premium. A tailored approach allows you to customize the policy to your unique needs and circumstances.

Policy Features and Benefits

Yo, check this out, fam. Understanding the nitty-gritty of Prudential’s long-term care insurance policies is key to making the right choice. This section breaks down the different policy features and benefits, comparing them to the competition, so you can see what’s up.This breakdown will help you navigate the jargon and get a clearer picture of the different policy options, their pros and cons, and the types of care Prudential covers.

It’s all about getting the lowdown on what you’re actually buying.

Key Policy Feature Comparison

This table lays out some key differences between Prudential’s policies and some popular competitors. It’s a quick snapshot, but it’s essential for seeing the variations in daily benefit amounts, waiting periods, and what’s excluded.

| Policy Name | Daily Benefit Amount (Example) | Waiting Period (Example) | Exclusions (Example) |

|---|---|---|---|

| Prudential Premier Care | $250 | 90 days | Pre-existing conditions (after a certain period), mental health issues (depending on the plan) |

| Prudential Advantage Care | $200 | 60 days | Substance abuse, self-inflicted injuries, and certain chronic illnesses |

| Competitor A | $225 | 90 days | Pre-existing conditions, certain medical procedures, and care outside the U.S. |

| Competitor B | $200 | 60 days | Pre-existing conditions, self-inflicted injuries, and hospice care |

Policy Options: Pros and Cons

Different policy options offer varying benefits and exclusions. Knowing these trade-offs is crucial. Understanding the pros and cons helps you make a well-informed decision.

- Higher Daily Benefit Options: These policies often have larger daily payouts, which can be crucial if extensive care is needed. However, the premiums tend to be higher. Think about it like this: a higher daily benefit might mean more cushion in a crisis, but it comes with a bigger upfront cost.

- Shorter Waiting Periods: These options allow you to access benefits sooner if you need care. But a shorter wait often translates to a higher premium. Consider this: quick access to benefits might be valuable, but it could also cost more.

- Comprehensive Coverage: Policies with extensive coverage may include a wider range of care types, from assisted living to home care. This might be the better option for those who want to avoid any gaps in care. This means less worry about unexpected expenses.

Types of Care Covered

Prudential’s LTCI policies typically cover various types of care. Understanding the scope of coverage is vital for planning.

- Nursing Home Care: This is standard coverage and covers the cost of care in a nursing home. This is a key benefit for those needing extensive assistance.

- Assisted Living: Some policies cover assisted living facilities, providing support for individuals who need help with daily tasks. This option is helpful for those needing some assistance but not full nursing home level care.

- Home Care: This benefit covers the cost of home healthcare services. This can be a great option for those who prefer to remain in their homes.

Policy Comparisons and Recommendations

Navigating the long-term care insurance (LTCI) market can feel like navigating a concrete jungle. Different policies, from different providers, all promise the same thing – peace of mind. But the devil’s in the detail. This section breaks down how to compare Prudential’s LTCI plans with top competitors, offering practical advice for potential policyholders.Understanding the various policy structures is crucial.

This involves examining premiums, coverage amounts, and waiting periods, all vital elements in a long-term care plan. Comparing these aspects across insurers, including Prudential, gives a clearer picture of the overall value proposition.

Policy Comparisons Table

A direct comparison of plans from Prudential and leading competitors is essential for informed decision-making. The table below highlights key features, providing a snapshot of the available options.

| Plan Name | Premiums (Annual) | Coverage Amount (Daily/Monthly) | Waiting Period (Days/Months) | Insurer |

|---|---|---|---|---|

| Prudential Advantage LTCI | £1,500 – £3,000 | £150/day – £450/day | 90 days | Prudential |

| Prudential Premier LTCI | £2,500 – £5,000 | £250/day – £750/day | 90 days | Prudential |

| MetLife SecureCare LTCI | £1,200 – £2,500 | £100/day – £200/day | 90 days | MetLife |

| AIG Long-Term Care Plan | £1,800 – £4,000 | £180/day – £400/day | 180 days | AIG |

Note: Premiums and coverage amounts are illustrative examples and may vary based on individual circumstances. Waiting periods are standard examples and can change depending on the policy and individual circumstances.

Recommendations for Prudential LTCI Options

Considering a hypothetical customer profile – a 55-year-old with a moderate income and a desire for comprehensive coverage – these recommendations provide a structured approach to evaluating Prudential’s LTCI plans:

- Prioritize comprehensive coverage: Consider the daily benefit amount. A higher daily allowance ensures adequate financial support during long-term care, matching the potential costs of care.

- Evaluate waiting periods: A shorter waiting period reduces the financial gap between the onset of need and the commencement of benefits. For instance, a 90-day waiting period is more advantageous than a 180-day period, ensuring quick access to benefits.

- Analyze premium costs: Evaluate the long-term financial implications of premiums. A higher premium could be offset by higher coverage or other benefits. For instance, consider how premium payments align with expected costs and lifestyle.

- Seek professional advice: Consult with a qualified financial advisor to assess the suitability of various Prudential LTCI plans based on individual needs and financial situation.

Plan Strengths and Weaknesses

Prudential’s LTCI plans, like others, have strengths and weaknesses, as revealed by customer reviews. Some plans excel in specific areas while potentially lacking in others.

- Prudential Advantage LTCI: Generally praised for its competitive premiums. However, reviews suggest that coverage amounts might be lower than expected by some customers.

- Prudential Premier LTCI: Noted for higher coverage amounts, catering to individuals requiring substantial financial support. However, higher premiums are often a drawback for some policyholders.

- Comparing Prudential to Competitors: Prudential’s plans often fall within the competitive range of premiums and coverage. Thorough research is crucial to pinpoint the optimal match for individual needs.

Illustrative Scenarios and Examples

Navigating the complex world of long-term care insurance (LTCI) can feel like tryna decipher a cryptic text. But these scenarios’ll break it down, showin’ how Prudential policies might fit different life stages and needs, from chronic illness to active retirement. We’ll show you the potential benefits and costs, so you can make an informed decision.

Chronic Illness Scenario

This scenario focuses on a 65-year-old with a history of severe arthritis, requiring regular physical therapy and medication. They’re concerned about potential future care needs, and want coverage for both skilled nursing care and assisted living.

- Prudential policy A covers skilled nursing care for a maximum of 10 years, with a daily benefit of £200. This policy also provides a monthly benefit for assisted living care of £1,000, payable for a maximum of 10 years. The premium is £500 annually.

- Prudential policy B offers a broader range of care options, including home health aide services and respite care. It covers skilled nursing for 15 years, with a daily benefit of £250. Assisted living is also covered for 15 years with a monthly benefit of £1,500. The premium is £650 annually.

Policy B provides a significantly higher level of coverage for a slightly increased premium. The choice hinges on the individual’s estimated future care needs and financial capacity.

Active Senior Scenario

This scenario highlights a 70-year-old, highly active senior who enjoys gardening, volunteering, and social activities. They’re concerned about potential future cognitive decline and want to maintain their independence for as long as possible.

- Prudential policy C provides coverage for memory care facilities for a maximum of 10 years, with a daily benefit of £250. It also covers home healthcare for a maximum of 5 years with a daily rate of £150. The annual premium is £400.

- Prudential policy D includes coverage for a range of care options, including assisted living and home healthcare. It offers memory care for 15 years, with a daily benefit of £300. Home healthcare is covered for up to 10 years with a daily benefit of £200. The annual premium is £550.

Policy D provides broader care options and a longer coverage period, offering more flexibility in responding to potential future needs. The choice between these policies heavily depends on individual expectations of future health and care requirements.

Hypothetical Policy Scenarios

| Scenario | Policy | Daily Benefit (Nursing Home) | Monthly Benefit (Assisted Living) | Annual Premium |

|---|---|---|---|---|

| Chronic Illness (65-year-old) | Policy A | £200 | £1,000 | £500 |

| Chronic Illness (65-year-old) | Policy B | £250 | £1,500 | £650 |

| Active Senior (70-year-old) | Policy C | £250 | N/A | £400 |

| Active Senior (70-year-old) | Policy D | £300 | N/A | £550 |

This table presents a concise overview of potential costs and benefits for different policy options. These examples illustrate how the chosen policy could significantly affect the financial burden of future long-term care.

Understanding the Claims Process

Navigating the claims process for long-term care insurance can feel like a maze. Knowing the steps, timelines, and required paperwork is crucial for a smooth experience. Prudential, like other providers, has specific procedures to follow, and understanding them can save you a headache down the line.The Prudential long-term care insurance claims process, while designed to be fair, requires careful attention to detail.

Knowing what to expect, and what documents are needed, is key to avoiding delays or rejection. This section will Artikel the process, highlight common pitfalls, and equip you with the knowledge to confidently navigate this critical aspect of your policy.

Claims Process Overview

The claims process typically involves several key steps. First, you’ll need to gather all required documentation, including medical records, diagnoses, and relevant policy information. Next, you’ll submit a formal claim application, detailing your specific needs and circumstances. This application often requires specific forms and supporting evidence. Prudential will then review your claim, potentially requesting additional information.

Finally, a decision will be made, either approving or denying the claim, with reasons for denial, if applicable. Prompt communication and adherence to the stipulated timeline are crucial throughout the entire process.

Required Documentation

A crucial aspect of a successful claim is the provision of complete and accurate documentation. This includes medical records, physician statements, and any other evidence supporting your claim. Policy terms and conditions Artikel the precise documentation needed for specific types of claims. Failure to provide complete documentation can delay or prevent your claim from being processed. Always retain copies of all submitted documents.

Scrutinizing Prudential’s long-term care insurance reviews reveals a complex landscape. While many policies offer comprehensive coverage, understanding the fine print is crucial. Supplementing your health strategy with beneficial products like MCT oil powder and collagen ( mct oil powder and collagen ) could prove advantageous, but ultimately, the best long-term care insurance solution remains highly individualized. Thorough research and consultation are key to making an informed decision.

Timeline Expectations

Prudential’s policy typically Artikels expected timelines for processing claims. These timelines can vary based on the complexity of the claim and the availability of required information. Contacting Prudential directly regarding your claim’s status is often recommended to stay informed of progress and any potential delays. It’s wise to anticipate a period of several weeks, or even months, for the process to be completed.

Types of Claims and Outcomes

| Claim Type | Description | Example | Outcome |

|---|---|---|---|

| Custodial Care Claim | Claim for assistance with activities of daily living (ADLs) | Assistance with bathing, dressing, and eating | Approved/Denied |

| Skilled Nursing Claim | Claim for skilled nursing care in a facility | Hospitalisation, rehabilitation or chronic care in a facility | Approved/Denied |

| Home Healthcare Claim | Claim for home healthcare services | Physical therapy, occupational therapy, or speech therapy in a patient’s home | Approved/Denied |

Common Reasons for Claims Denial

Prudential, like other insurance providers, may deny claims for various reasons. Common reasons include insufficient documentation, failure to meet policy requirements, or lack of evidence supporting the need for long-term care. Claims can also be denied if the care provided doesn’t align with the approved care plan, or if the condition doesn’t meet the definition of a covered illness.

In cases of denial, Prudential will typically provide a detailed explanation of the reason for rejection.

Policy Details and Specifics

Yo, peeps, getting down to brass tacks with Prudential’s long-term care policies. We’re breakin’ down the nitty-gritty details, so you can see exactly what you’re gettin’ into. From policy names to daily benefits, we’re layin’ it all out for you, straight up.

Prudential LTCI Plan Breakdown

This table gives you a lowdown on some common Prudential LTCI plans. It’s a snapshot of different policy options, showing the price tag, the daily cash injection, and any initial fees. Important note: Premiums and benefits can vary widely based on your individual situation, so always check with a qualified advisor.

| Policy Name | Premium Amount (approx.) | Daily Benefit Amount | Deductible |

|---|---|---|---|

| Prudential GuardianCare Select | $100-$300+ per month | $100-$250 | $500 – $1000 |

| Prudential GuardianCare Plus | $150-$400+ per month | $150-$350 | $1000 – $2000 |

| Prudential GuardianCare Premier | $200-$500+ per month | $200-$500 | $2000 – $3000 |

Customer Review Snippet

“I was hesitant at first, but the Prudential GuardianCare Plus plan ended up being a solid choice. The daily benefit amount was decent, and the coverage felt comprehensive enough. However, the paperwork was a real pain, and the initial premium was higher than I expected. Overall, it’s a good plan, but you need to be prepared for the admin hassle.”

Comprehensive Policy Summary Example

This example shows a typical policy summary, highlighting key features and benefits of a Prudential GuardianCare Select plan. The important stuff is clearly laid out.

- Policy Name: Prudential GuardianCare Select

- Premium: $175/month (estimated)

- Daily Benefit Amount: $150

- Deductible: $750

- Coverage Period: Up to 5 years of care

- Eligibility Requirements: Must be 18+ and meet specific health conditions. This is crucial!

- Key Benefits: Covers skilled nursing, home health care, and assisted living facilities. It also includes options for inflation protection, making the plan more future-proof.

Final Review

In conclusion, Prudential’s long-term care insurance options present a range of choices, but prospective buyers must carefully evaluate the specific features, costs, and customer service reputation. The detailed reviews and comparisons offered here empower consumers to make informed decisions, weighing the potential benefits against potential drawbacks. Ultimately, choosing the right policy requires careful consideration of individual needs and circumstances.

Common Queries

What are the common types of long-term care insurance policies?

Common types include individual policies, employer-sponsored plans, and hybrid options. Each type offers varying levels of coverage and benefits.

What are the typical waiting periods for Prudential’s long-term care insurance policies?

Waiting periods can vary significantly depending on the specific policy. Consumers should carefully review policy documents to understand the exact waiting periods.

How does Prudential handle claims for long-term care insurance?

Prudential’s claims process, as detailed in their policy documents, Artikels the steps, timelines, and required documentation. Reviews may offer insight into the efficiency and effectiveness of their claims handling.

What are the common exclusions in Prudential’s long-term care insurance policies?

Exclusions vary by policy. It’s crucial to understand the specific exclusions to avoid potential coverage gaps. Policy documents should be thoroughly reviewed for complete details.